Contents:

The probabilities of earning money are close to adverse as costs have gone greater. If you are looking to buy get some discount deals, as in the intervening time, we do not see an excessive amount of when it comes to demand nor an upside. How excessive prices will prevail in the course of the course of the 12 months is not predictable, hence you should purchase on declines.

Once the interest rates increase, people sell off their gold and try to use the money to earn high interest. When interest rates fall, they see more sense in buying gold, thus increasing its demand. However, this is more of a short-term observation as over a long period, it is seen that gold price and interest rates both have risen, thus indicating a long-term positive correlation. For example, during the 1970s gold boom, prices rose in spite of a steady rise in interest rates.

SERVICES

The gold rates in India were recorded at Rs 55,950 for 10 grams of 22 karats and Rs 61,040 for 10 grams of 24 karats. The gold price in India touched an all-time high on Thursday’s trade session as it took cues from the bullion markets after the Fed-fueled run of the gold rates in the international markets. The gold rate in India was seen at Rs 57,000 for 10 grams of 22 karats and Rs 62,180 for 10 grams of 24 karats.

Hence, any depreciation in the dollar increases the gold value and vice versa, as already discussed above. Gold price in the last 10 years.Now that we have understood how gold prices are affected, let’s consider the factors contributing to the rise of gold prices in recent times. Conversely, when interest rates move northward, people sell it for investing in deposits to get a high interest income, prompting a fall in demand and prices.

Helps tackle inflation

A secured loan is offered by most banks, NBFCs and other private financial institutions. With gold as the collateral, you can fetch up to 90% of the gold value as a loan to be repaid with bank interest within the specified time. Digital gold trading does not require deep financial expertise. All you need is a mobile phone, a good internet connection and a platform like Khatabook to buy digital gold. Gold Market trade -Gold stocks are traded in ETFs (exchange-traded funds ) and spot contracts. The demand for ETFs has seen a steady fall over the past two years.

So, if you’re a long term investor, it could help you earn cash. However, recently the rise within the treasured steel has been too quick and livid and therefore returns in the future may not be forthcoming. The liberalisation has integrated the domestic market with the global market and hence any variation in global gold market affects the domestic market more.

When the interest rates decrease, people buy more gold resulting in increase in demand. Gold rates in Hyderabad and other cities in India depend on various factors including its currency exchange rates as the country is a net importer of the yellow metal. Gold is not just a precious metal but its rates in Hyderabad, Dubai, Riyadh and other big cities of the world indicate the market trends. The rates of the yellow metal depend on various factors including geopolitical stability, wars, pandemic, uncertainties, etc.

This way, gold investment in India can act as a safety net against the volatility of markets. With a plethora of options available today, gold investment in India is not just limited to buying gold in its physical form. In this article, let us understand key details about gold investment in India, including taxation and things to consider before investing. If the economy revives, it may reduce the gold price, and you may have to look for other investment avenues.

Gold ETFs have several advantages such as liquidity, safety, tax benefits, and is cheaper than buying physical gold. Like all central banks, the Reserve Bank of India holds gold reserves for the future, and it has a crucial impact on the gold rate. If the RBI decides to preserve the reserve of gold, the gold prices will increase, because of the decreased supply of the gold in the market. If the market is volatile or bearish, scared investors scramble to transfer money to precious metals such as gold, which has historically been viewed as a reliable, dependable metal with transferable value. For the investors who are losing money in the stock market, trading in precious metals can create nice returns.

Today Gold Price: Get latest Gold Rates in India today – Hindustan Times

Today Gold Price: Get latest Gold Rates in India today.

Posted: Fri, 13 Jan 2023 08:42:00 GMT [source]

Hence, the adoption of new technology in the production and marketing process to a greater extent is useful for sustainable production, consumer confidence and profitability of the producers. Every state in India has specific rules and regulations that play a crucial role in determining the prices of Indian gold in that specific state. Therefore, you might have observed that the gold price in Delhi is not the same as the prices in Ahmedabad. When gold gets imported from other countries, the state government imposes taxes, impacting the final gold selling price. Besides the jewelry market, the prices of gold also depend on how much gold electronic manufacturing companies buy.

Factors affecting Gold Prices in India

It is under the regulatory oversight of SEBI as well as NSE and BSE which on a routine and ongoing basis audit our performance, books of account and other particulars. A recent routine inspection in August 2019 was carried out by SEBI, the Exchanges and the depositories. Upon submission of the preliminary inspection report by NSE to SEBI, the regulator issued an ex-parte ad-interim order dated 22-Nov-2019 issuing directives in investor interest. The nature of this order is such that by definition, it is an ‘interim’ directive and not a final finding. The order itself states emphatically, that this is in response to preliminary findings and is subject to further review upon a more comprehensive audit and investigation.

However, remember the change in rupee-dollar rates has no impact on gold rates denominated in dollars. Demand from ETFs and Central Banks is another factor that affects gold prices. For too long, the central banks were the largest holders of gold reserves.

SGX Nifty, gold price to US dollar — factors that may impact global markets today — 10th February Mint – Mint

SGX Nifty, gold price to US dollar — factors that may impact global markets today — 10th February Mint.

Posted: Fri, 10 Feb 2023 08:00:00 GMT [source]

If you are looking to make regular investments as opposed to a one-shot investment, gold funds can be a better and more rewarding option. However, for investors looking for a cost-effective option, Gold ETFs can be the right choice. Therefore, it is vital to make sure that your investment portfolio is designed to face all weather storms. With gold funds, you can enjoy the benefits of professional fund management. Each gold fund is assigned a fund manager who takes the investment decisions as per the objective of the fund. The returns generated from a gold fund is similar to that of a gold ETF.

When there is a dip in the value of Indian currency against the rate of the dollar, the rate of gold in India sees a hike. Physical Gold Coins And Bars – One can also buy gold in its physical format by obtaining bars, coins, or jewellery. Read this article to know about today’s gold rate in India live. The gold rate in India was seen at Rs 56,500 for 10 grams of 22 karats and Rs 61,640 for 10 grams of 24 karats. Results from a certain research has predicted that the price of gold will surge by at least 260% at $5,000 an ounce by the year 2020.

However, the price of gold fluctuates backed by several factors. Despite fluctuations, the gold price has surged by nearly 900% in the last 10 years. However, it’s unlikely that there can be many elements that affect gold costs they usually all work in tandem with one another. How the government alter its policies can be essential in the wake of adjustments that we see to the way its policies change. After the Union Budget, there were some modifications made to the excise and different duty adjustments that had been done.

Is Gold More or Less Valuable During a Recession? – Yahoo Finance

Is Gold More or Less Valuable During a Recession?.

Posted: Mon, 21 Nov 2022 08:00:00 GMT [source]

Global shares of gold have continuously elevated in current many years and are currently at their highest degree. The study makes use of secondary data collected from the Report of World Gold Council and the Reserve Bank of India Bulletin. The Compound Annual Growth Rate is used to evaluate the temporal dynamics and growth in gems and jewellery sector in India. The price of gold fluctuates a great deal over time and to evaluate the instability in gold price, Cuddy-Della Index of Instability is used. The higher the score, the higher is the instability and vice-versa. The CDII is worked out for both pre and post liberalisation phases and the values are compared to identify any change in the instability score of gold price during the two periods.

Gold Rates Today in India

From its use during elaborate wedding ceremonies, to embellishing oneself with jewellery during important festivals like Diwali, gold holds a special place in the Indian households. Thus, during the wedding and festival seasons, the price of gold goes up, as a result of the increase in consumer demand. Some media has alluded to the fact that our rapid diversification in last few years has resulted in this situation.

One can determine its purity by checking the BIS Mark, which denotes it as a hallmarked product. You can also request doorstep delivery in the form of coins or gold bars. Alloy Prices – check the prices of silver, copper etc., as they are usually mixed with gold to make it stronger. A series of collapse of the U.S.-based banks has forced the Fed to pause the interest rate hike from the Fed helping the metal to surge strongly.

gold price depends on which factors in india Gold – It can be bought online, where the seller stores an equal quantity of physical gold in vaults on a customer’s behalf. A buyer can be assured of obtaining the purest form of this precious metal when buying them online via platforms such as KredX. One of the most important features of this asset class is its steady nature as compared to currency. In times of high inflation, the value of the money goes down while the value of gold surges or remains almost stable. The information, product and services provided on this website are provided on an “as is” and “as available” basis without any warranty or representation, express or implied. Khatabook Blogs are meant purely for educational discussion of financial products and services.

Trump’s economic program was predicated on massive tax cuts and a big push to infrastructure. Both these moves had the potential to give a big boost to economic growth. When economic growth returns to an economy, investors would typically prefer to participate in this growth through equities rather than park their monies in gold. That explains why gold prices fell sharply after Trump became the President of the US.

Early Tuesday, prices hit an all-time high of $1,917.90 an ounce, before pulling back to about $1,880. In simple words, 24K gold is also called pure gold and has 99.9 per cent purity. On the other hand, 22K gold comprises 22 parts of gold mixed with two parts of other metals like copper and zinc.

- Commodities are categorised into two different categories, which are hard commodities and soft commodities.

- With the rise of global economic uncertainty, the interest rate slumped.

- In the commodity market, one of the most commonly traded commodities is gold.

- On the other hand, 22k gold is basically 22 parts of gold and two other metals like copper and zinc.

- With gold as the collateral, you can fetch up to 90% of the gold value as a loan to be repaid with bank interest within the specified time.

After heavy hammering of the precious metal in 2018, gold is again and how. It is the official marking of precious metals by the Bureau of Indian Standards. It is the guarantee of a metal’s fineness or purity.Its main objective is to protect the buyer from adulteration and also obligate the manufacturers to ensure legal standards of fineness. In India, gold is officially marked by the Bureau of Indian Standards.

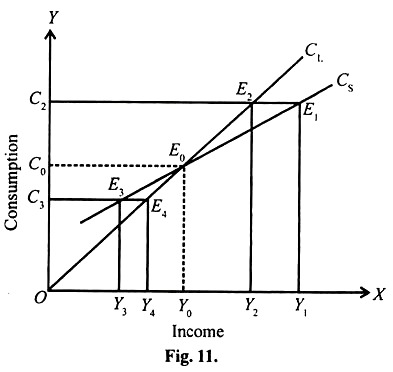

It is obvious that gold price shows a kind of co-integration of the domestic gold prices with the global prices. But in a pre-post-liberalisation comparison, the post-liberalisation period is more integrated with the global prices than the pre-liberalised. The domestic price of gold was more than the global price during most of the years of the pre-liberalisation era as the price of gold in India on an average was 30 percent more than the international price. But the caveat in gold liberalisation is that it is integrating the domestic market with the global market and any reverberation in the global gold market has affected the domestic market unequivocally. This is well authenticated with Cuddy-Della Index, regression and correlation inferences all of which show an augmented reality of global integration of prices and its dynamics.