Content

The reversing entry typically occurs at the beginning of an accounting period. It is commonly used in situations when either revenue or expenses were accrued in the preceding period, and the accountant does not want the accruals to remain in the accounting system for another period. A reversing journal entry is an exact opposite of the original journal entry.

- For the current period, he would just have to record the expenses and revenue as they come in and not worry about the accrued and prepayments of the last period.

- When your spouse sends out invoices on April 3, the accounting software automatically records another $2,000 in accounts receivable for the same client.

- Generally, a company will only make reversing entries if it uses accrual basis accounting.

- An example of this would be a company that rented some video equipment from a vendor (to use for work with a client) for $150 per day, for a total of 10 days.

- To illustrate reversing entries, let’s assume that a retailer uses a temporary employment agency service to provide workers from December 15 to December 29.

If the bookkeeper does not record these reversal entries, then he would have to remember which portion of the current expenses, for example, has already been paid out in the previous period. Therefore, there https://www.bookstime.com/ is a high chance of double-counting certain revenues and expenses. The practice of making reversal entries at the beginning of the accounting cycle will ensure that this error of double counting is avoided.

What is a reversing entry?

Reversing entries are a useful tool for dealing with certain accruals and deferrals. Their use is optional and depends on the accounting practices of the particular firm and the specific responsibilities of the bookkeeping staff. On Sept. 30, Timothy records a payroll accrual to reflect wages owed but not paid for Monday, Tuesday, and Wednesday. For example, if you posted a purchase order with the wrong quantity of products in one period, you could undo that posting with a reversing entry at the beginning of the next period. The same company rented some video equipment to complete the project. This equipment is billed by the day, and it was rented for the full 10 business days of the project.

JPMorgan Chase Fixes ‘Issue’ That Caused Duplicate Transactions … – PYMNTS.com

JPMorgan Chase Fixes ‘Issue’ That Caused Duplicate Transactions ….

Posted: Fri, 02 Jun 2023 20:07:38 GMT [source]

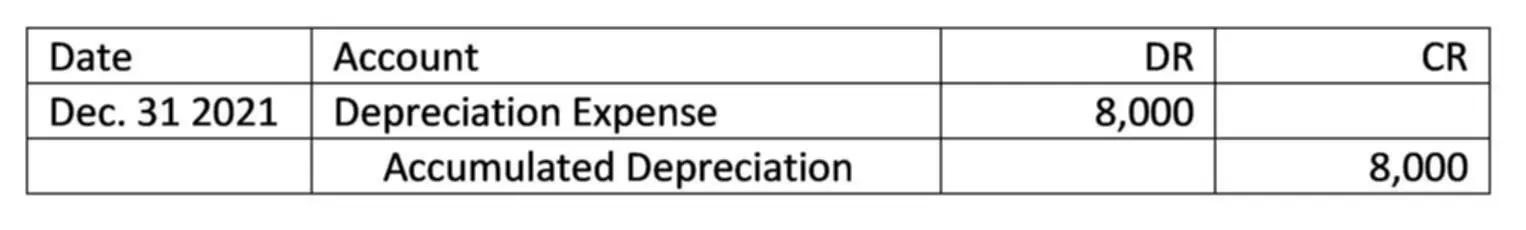

As a result, the account Temp Service Expense will begin January with a zero balance. One is when it comes to accrued payroll, where you would need to make a reverse entry the following month when wages are actually paid. Reversing entries work to clear out any accruals that you do not want reflected in the new accounting period. This will be offset by the actual bill recorded on February 8 and paid upon receipt. It is important to note that the total expense was $1,500.00 but $750 was from the prior month and $750 from the current month. If you know at the time of creating a journal that you want it to be reversed at a point in time in the future, you can set it up as a reversal journal entry at the time of creation.

Note

For example, if an accrued expense was recorded in the previous year, the bookkeeper or accountant can reverse this entry and account for the expense in the new year when it is paid. The reversing entry erases the prior year’s accrual and the bookkeeper doesn’t have to worry about it. Another example of a reversing entry would be if you accrued a $10,000 expense in February, but the supplier does not send the actual invoice until March.

An accountant in another life, Timothy uses the accrual basis of accounting. Without a reversing entry, you’d have a $10,000 expense on your books until the bill comes in. You’d then have to do some accounting and arithmetic gymnastics to record the $9,500 invoice accurately.

The Accounting Cycle Example

If you were to forget to reverse the expense in the second example, the accounting records would show a $20,000 expense in January and another $20,000 expense in February, where the February amount is erroneous. The key indicator of this problem will be an accrued liability of $20,000 that the accounting staff should locate if it is periodically examining the contents of the company’s liability accounts. Learn how to reverse a journal entry to swap the debits and credits, or delete it entirely. The original accrual entries are made in one month in the GL Journal Transaction Entries program. The reversing entries are made in the following month automatically by running the GL Auto Reversal Entries program. An entry may be held and reversed in a later month than the first month following the accrual.

Reversing entries are journal entries are used to cancel or neutralize entries made in the previous accounting period. The reversing entry, to be entered on April 1, would then be a debit to Accrued expenses for $200 and a credit to Advertising Expenses for the same amount. You should only create journal entries as a last resort or with the help of your accountant.

Reversing Entries

With automatic reversing entries, your accounting software will automatically make a journal entry at the end of the month and record a reverse entry at the start of the new month. Both types of reversing entries work the same as far as debiting and crediting your general ledger. For example if Company X wanted to make an adjustment for $600 in unpaid wages, it would debit that amount from the wages expense account and credit it to the wages payable account. You may want to set up a journal entry to automatically reverse itself.

- Make note of this each month until you do reverse the entry, as this can prevent entries mistakenly going unreversed.

- As can be seen in the ledger accounts, the net effect is that a $50 interest expense will be realized in October, and the full $100 of interest will be paid to the holder of the note.

- Ajera adds the suffix – Reversed to a reversed journal entry description.

- On Sept. 30, Timothy records a payroll accrual to reflect wages owed but not paid for Monday, Tuesday, and Wednesday.

- These entries are optional depending on whether or not there are adjusting journal entries that need to be reversed.

- Reversing entries work to clear out any accruals that you do not want reflected in the new accounting period.

If the estimated amount is $18,000 the retailer will debit Temp Service Expense for $18,000 and will credit Accrued Expenses Payable for $18,000. This adjusting entry assures that the retailer’s income statement for the period ended December 31 will report the $18,000 expense and its balance sheet as of December 31 will report the $18,000 liability. Another option for reversing entries is to make a complex entry that https://www.bookstime.com/articles/reversing-entries accounts for the accrual amount when the actual expense or revenue arrives. An example of this would be a company that rented some video equipment from a vendor (to use for work with a client) for $150 per day, for a total of 10 days. The accrual entry would debit Equipment Rental and credit Accounts Payable (A/P) for that amount. A reversing entry would debit A/P and credit Equipment Rental for the same amount.

Free Debits and Credits Cheat Sheet

Much of our research comes from leading organizations in the climate space, such as Project Drawdown and the International Energy Agency (IEA). Carbon Collective is the first online investment advisor 100% focused on solving climate change. We believe that sustainable investing is not just an important climate solution, but a smart way to invest. Carbon Collective partners with financial and climate experts to ensure the accuracy of our content.

To do this, define a journal in GL Journals for accrual entries to be made and and reference another journal (or the same journal) for the automatic reversing entry to be posted in the next (or later) month. A reversing journal entry is also permanently linked to the original entry. Any change you make to the original entry affects the reversing transaction. He has two employees who are paid every Monday for the previous week’s work.

Reversing entries are optional accounting procedures which may sometimes prove useful in simplifying record keeping. You now create the following reversing entry at the beginning of the February accounting period. This leaves the original $18,000 expense in the income statement in January, but now creates a negative $18,000 expense in the income statement in February.

Do you reverse year end accruals?

In the next fiscal year, the accruals for the prior fiscal year need to be reversed from the balance sheet so that expenses are not double counted when paid in the next fiscal year. Accruals are automatically reversed on the first day of the new fiscal year.

You can make transposition errors and other mistakes go away with a reversing entry. Reversing entries are a type of journal entry, which is how businesses record transactions. Between May 1 when the reversing entry is made and May 10 when the payroll entry is recorded, the company’s total liabilities and total expenses are understated. This temporary inaccuracy in the books is acceptable only because financial statements are not prepared during this period. But wait, didn’t we zero out the wages expense account in last year’s closing entries? This reversing entry actually puts a negative balance in the expense.

On January 7th, Paul pays his employee $500 for the two week pay period. Paul can then record the payment by debiting the wages expense account for $500 and crediting the cash account for the same amount. An adjusting entry was made to record $2,000 of accrued salaries at the end of 20X3. The next payday occurred on January 15, 20X4, when $5,000 was paid to employees. The entry on that date required a debit to Salaries Payable (for the $2,000 accrued at the end of 20X3) and Salaries Expense (for $3,000 earned by employees during 20X4). While you record reversing entries at the beginning of the month, it is possible to have an accrual that you do not immediately reverse.